Angel Investor VS Venture Capitalist

In today’s world, there is a significant increase in startups and new businesses. Every day, entrepreneurs come up with new and creative ideas, and to fulfill their dreams and ideas, they need to raise funding. Finding investors for your business idea is not a piece of pie for freshers. However, to give life to their dream business or startup idea, they require the right investors or capitalist.

There are mainly two types of investors in the market, angel investors or venture capitalists. Both types of investors invest money in startup businesses and take calculated risks for gaining handsome returns on the investments. This article will help entrepreneurs to learn the difference between an angel investor and venture capitalist. This article provides a guide on helping businesses identify which investor is right for you based on the type of your business and business requirements.

There are a lot of similarities in both investors, both of them prefer to invest in innovative and creative technology and science-based companies. The following are some of the differences that differentiate the two investors from each other.

Angel Investors

Angel investors are also known as private investors who have the capital to invest in various high-potential businesses in exchange for equity shares and revenues. Angel investors are individuals who invest their personal finances to start-up businesses. Since they invest their own money, there’s always a high inherent risk. Research shows that angel investors are more likely to invest in companies that are willing to give away a part of their company. On average, angel investors have a minimum of $2 million in income on a yearly basis.

Venture Capitalist

A venture capitalist is a group of professional investors. Venture capital firms are composed of general and limited partners like individual investors, corporations, and foundations. The general partners are the ones who are mainly responsible for managing the firms and deals with founders and entrepreneurs and make sure to maintain the healthy growth rate of the firm.

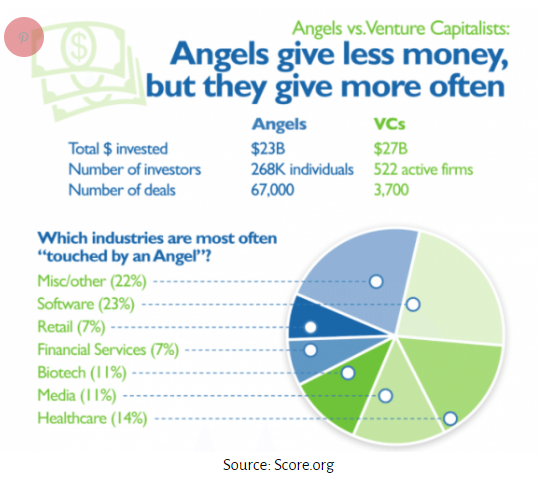

Where They Invest and How Much They Invest

Angel investors usually invest in start-ups or newly established businesses that have a lot of growth potential, but limited resources. Some angel investors have strict criteria that the entrepreneur companies should meet which includes the revenue streams, time spent in the industry, scope, and popularity of the product and the service. Angels investors give a limited amount of money at the initial level to just make the business run and in order to reduce the risk of loss. Although angel investors are considered to be a quick source. The angel investor on average makes only an investment of $1 million to $ 4 million for a startup business.

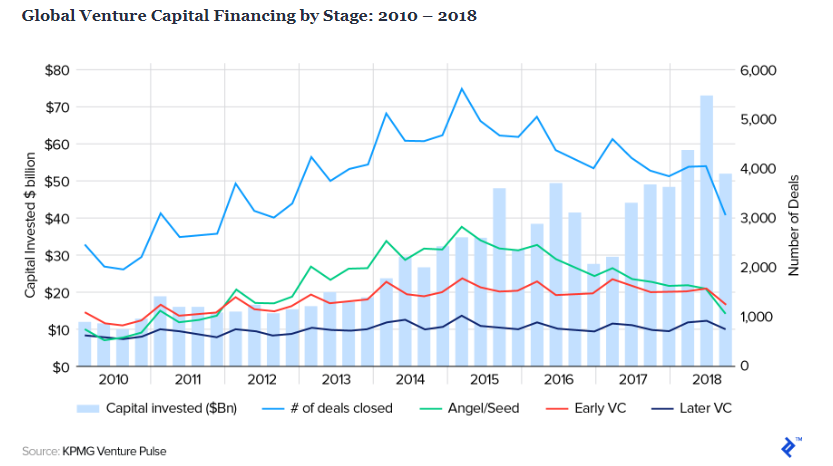

Venture capitalists are more likely to invest in company expansions or already established businesses to reduce their risk of loss. Although some of the venture capitals also invest in a high potential startup business with highly experienced business owners. A venture capitalist is able to invest almost double the amount as compared to an angel investor. On average, the venture capitalists are able to invest an amount of $7 million or more.

Investors Roles and Return Expectations

Angel investors mostly act like mentors or business partners to help entrepreneurs to establish the business and to increase the company’s revenues. Angel investors also introduce entrepreneurs to important contacts that help them grow their business and fulfill various business needs. The involvement of an angel in the business depends upon company type and relationship between the investor and the entrepreneur. They can prove to be an efficient resource that can guide individuals who are new in the market with contacts and pass on knowledge for effective decision-making. Angel investors expect to get their money back in the time frame of 5 to 7 years with 20-30% interest.

A venture capitalist usually hopes to become a part of the board of directors. They participate in the company to develop a strong service and product with a strong competitive advantage. They also help in developing companies’ real value, and to make the company’s future strategies and, for recruiting senior management. Venture Capitalists’ primary aim is to help entrepreneurs make their businesses more profitable. Venture capitalists expect to get their money back in the time frame of 3 to 5 years with 25%- 35% interest.

Whether entrepreneurs want

venture capitalist or angel investors to invest in their businesses- they need

to prepare their investment pitch-perfect. It is recommended to search for all

available investors in the target market who would like to invest in your

business. The proposal should include business plans, financial statements,

market analysis, and marketing plans. In addition to this, give detailed

information on how much funds are required and where you are going to spend it

and how much money has already been invested in the business.

References:

[1] https://lotops.com/how-to-raise-funds-with-angel-investors/

[2] https://lotops.com/how-to-raise-funds-with-angel-investors/

[3]https://www.toptal.com/finance/venture-capital-consultants/state-of-venture-capital-industry-2019